Want to raise financially smart kids? These 7 strategies will help you teach kids about finance and money—from saving and investing to using their finances to make a difference. Plus, each one comes with an easy activity so you can put these lessons into action right away!

You know what your kid’s school isn’t teaching? How to earn, save, invest, or avoid blowing their entire allowance on gummy worms.

So, guess who gets to teach them? Yep—you do.

But don’t worry, it’s easier (and way more fun) than you think! Learning to teach kids about finance and money doesn’t require a finance degree—just a few simple strategies and real-life lessons they’ll actually enjoy.

In this post, I’ll share 7 easy ways to help your kids build smart money habits—without the stress, lectures, or glazed-over stares.

Let’s start with the one skill that makes all the difference: mindset.

1. Strategy #1: Teach Delayed Gratification Through Savings Goals

Teaching kids about finance and money isn’t just about saving and spending—it’s also about helping them develop the mindset that builds wealth. And one of the most powerful financial skills they can learn? Delayed gratification.

The Bible puts it beautifully in Hebrews 12:11:

“No discipline seems pleasant at the time, but painful. Later on, however, it produces a harvest of righteousness and peace for those who have been trained by it.”

Which means: waiting is tough, but it builds character, wisdom, and long-term prosperity.

Try this: Savings goal Challenge

This simple activity makes patience fun and rewarding while teaching kids about saving money.

- Let your child pick a goal.

- It could be a toy, a fun experience, or something they’ve been asking for. It must be something they’re excited about!

- Create a visual savings tracker.

- Use a clear glass jar for their money so they can physically see it grow.

- Or get creative with a printable tracker they can color in as they save.

- Check in weekly.

- Encourage them to save a portion of their allowance or money they earn.

- Talk about how great it will feel to finally reach their goal.

- Celebrate—but no bailouts!

- Once they hit their goal, let them experience the pride of buying it themselves.

- No shortcuts—they’ll appreciate it way more knowing they earned it!

By experiencing the power of patience, kids start to understand money differently. As a result, they learn that waiting isn’t punishment—it’s a strategy for success. This is the very first step when trying to teach kids about finance and money. Now that they have the mindset, let’s move on to tangible money.

2. Strategy #2: Show the Difference Between Real and Digital Wealth

It’s crazy when you think about it—the currency we trade every day is just paper. And these days, most people don’t even use physical cash—it’s just numbers on a screen. So, how does money actually hold value?

Since the beginning of time, the things that have retained real, lasting wealth aren’t paper bills or digital bank balances. Instead, it’s been precious metals, land, livestock, commodities, art, tools, etc..

Here’s how to explain it to your kids:

Think of tangible wealth as something you can hold, trade, or use to create more money. Unlike digital money, which exists on a screen, these things have real, lasting value.

Try this: Treasure hunt for real wealth

- Take your child around the house and find things with tangible value (jewelry, tools, even an old collectible).

- Discuss what makes them valuable: Can you trade it? Sell it? Use it to make more money?

- Then, give them a few coins of different metals (pennies, nickels, quarters, silver, gold) and explain that some materials hold value better than others.

- If possible, take them to a coin shop, a farm, or a real estate open house to see tangible wealth in action!

In short, this activity helps kids understand that real wealth isn’t just numbers—it’s about owning things that hold inherent value over time. Next up: active vs. passive income.

3. Strategy #3: Active vs. Passive Income

The way I learned to think about the two types of income was:

- Active income = trading time for dollars a.k.a. you have to be there to make money

- Passive income = having money work for you a.k.a. you don’t have to be there to make money.

For example, if you have a job, then that’s active income. If you own assets like real estate, businesses, etc. then that’s passive income.

Let’s be clear – passive income doesn’t mean ‘do nothing and get rich.’ It means you put in the effort upfront so that, later, money comes in with less daily work.

That’s why delayed gratification as a foundation is really important. Setting up passive income streams takes A LOT of work upfront. I’m actually working on this right now – I’ve spent the last 6 months renovating a rental property that’s finally ready to rent and I haven’t earned a single penny yet.

But that’s okay, because I know 10 years from now it’ll be worth it. The goal is one day, your kids can build enough passive income to have more freedom—more time for family and the things that matter most.

Try this: The Toy Rental Experiment

Step 1: Ask your child to pick a toy they don’t play with all the time.

Step 2: Explain they have two ways to make money with it:

- Active Income: Sell the toy for $5 and get cash immediately.

- Passive Income: “Rent” it to a sibling, friend, or even a parent for $1 a day for a week.

Step 3: At the end of the week, see which option made them more money and talk about the trade-offs.

This is an easy way to introduce them to the two different types of income. That brings us to the next topic: assets vs. liabilities.

4. Strategy #4: Assets vs. Liabilities

It’s time for one of the most important lessons: Assets vs. Liabilities. This framework I’m about to explain will change the way that you and your child view money forever.

- Asset = something you own that puts money in your pocket

- Liability = something you own that takes money out of your pocket

Robert Kiyosaki, the author of Rich Dad Poor Dad, famously said something along the lines of: the house you live in is not an asset, it’s a liability. Which means, if you are paying down the mortgage yourself, is money coming into your pocket every month or leaving it? That’s right, it’s leaving your pocket so it’s a liability.

When you own a house that you rent to someone else, they are paying your mortgage. If you did your math right, then money is being put into your pocket every month and therefore it’s an asset.

That same house can be an asset or liability depending on what you do with it. Same thing with a car, boat, etc.

Try this: Cashflow board games for kids

- Get the Cashflow for kids board game here and have a family game night!

- Talk to your kids about the different decisions they’re making and why.

- Enjoy a fun game as a family that teaches them real life skills about investing!

By the way, you’re halfway through and already miles ahead of other parents who haven’t yet learned how to teach kids about finance and money. Next up is the topic that gets me the most excited: investing!

5. Strategy #5: Why Starting Investing Early Matters

When I was 9, fresh off playing the Cashflow for kids board game, I was obsessed with investing. Because of this, I was full-on begging my parents:

“Take my allowance! All of it! I don’t even want to spend it—just invest it because I legally can’t, and I need to start NOW!”

Looking back, it’s kind of hilarious, but I think I had the right idea. I understood one of the biggest financial secrets: the earlier you invest, the more your money grows—all thanks to the magic of compound interest.

Here’s the deal: Investing makes your money work for you. A good investment takes money out of your pocket at first, but then it brings back friends (dollars). And if you reinvest those returns? That’s when you’re on the fast track to financial freedom.

It’s the single most powerful way to build wealth over time.

Try this: Seed Starter Investing

- Give your child a small amount of money—let’s say $5 to $10. Or have them use their allowance “Investing” fund that they learned about in this blog post.

- Explain that they can either:

- Spend it now (instant gratification).

- Invest it by using it to buy supplies to grow the money (delayed gratification).

- Guide them in choosing an “investment.”

- Buying candy in bulk and reselling it at school (if allowed).

- Creating and selling homemade crafts.

- Offering a small service like washing cars, dog walking, or lemonade stands.

- Watch their investment grow! When they make a profit, show them how reinvesting works by rolling their earnings into a bigger project.

- Celebrate the lesson! Let them spend a portion and reinvest the rest—just like in real life.

Hopefully, they will have caught the “investing” bug and realize they can put their active income to work for them so it becomes passive income. As exciting as all of this is, let’s not forget what real wealth means. Proverbs 3:13-15 puts it plainly:

“Blessed are those who find wisdom, those who gain understanding, for she is more profitable than silver and yields better returns than gold. She is more precious than rubies; nothing you desire can compare with her.”

The bottom line is: wisdom and discernment are more valuable that tangible money and will set your children up for a life of prosperity. Investing is an important skill, but what really matters is teaching your kids to seek knowledge and understanding.

6. Strategy #6: Biblical Stewardship and Using Money as a Tool for Good

Some people will say that money is the root of all evil, but actually that’s a misquote from the bible. The full verse, 1 Timothy 6:10, says:

“For the love of money is the root of all evil…”

This verse doesn’t condemn money itself—it warns against greed. Which means, money is just a tool—a resource that can be used for good or for harm, depending on how we steward it.

When we place money above everything else, chasing it for selfish gain, we lose sight of what truly matters. But when we focus on serving others—using our God-given strengths to create value—money often follows as a natural byproduct.

It’s a beautiful cycle: The more people you help, the more money flows to you. And the more money that flows to you, the more people you can help. This is the real lesson to emphasize when you teach kids about finance and money.

Money isn’t the destination; it’s a means to create impact. Therefore, instead of worrying about chasing wealth, focus on serving others. Lead with generosity, provide value, and trust that provision will follow.

Try this: The Giving Jar

- Find a jar – Let your child decorate it with stickers, Bible verses, or drawings that remind them of generosity. Try Proverbs 3:9-10: “Honor the Lord with your wealth, with the firstfruits of all your crops; then your barns will be filled to overflowing.”

- Set a giving goal – Talk about different ways they can use money to bless others. Will they donate to church? Buy food for someone in need? Help a friend? Let them choose!

- Give with joy – When the jar fills up, let them personally deliver the money or gift. Celebrate how their generosity made a difference! Ask them how this experience made them feel.

By connecting financial education to service and impact, we show kids that money isn’t the goal—it’s a tool to create a better world.

7. Strategy #7: Use Financial Education to Teach Purpose and Generosity

The goal of teaching kids about finance and money isn’t just about accumulating wealth. It’s about giving them the tools to use their God-given strengths to serve others and create a lasting impact.

When kids understand how money works, they’re not just learning how to save or invest—they’re learning how to build a life of purpose. On top of that, the less financial stress they carry, the easier it is to live with peace, share joy, and give back to their families and communities.

That’s what we’re all here to do—use our gifts to serve, spread joy, and make a difference.

Try This: The Service Business Challenge

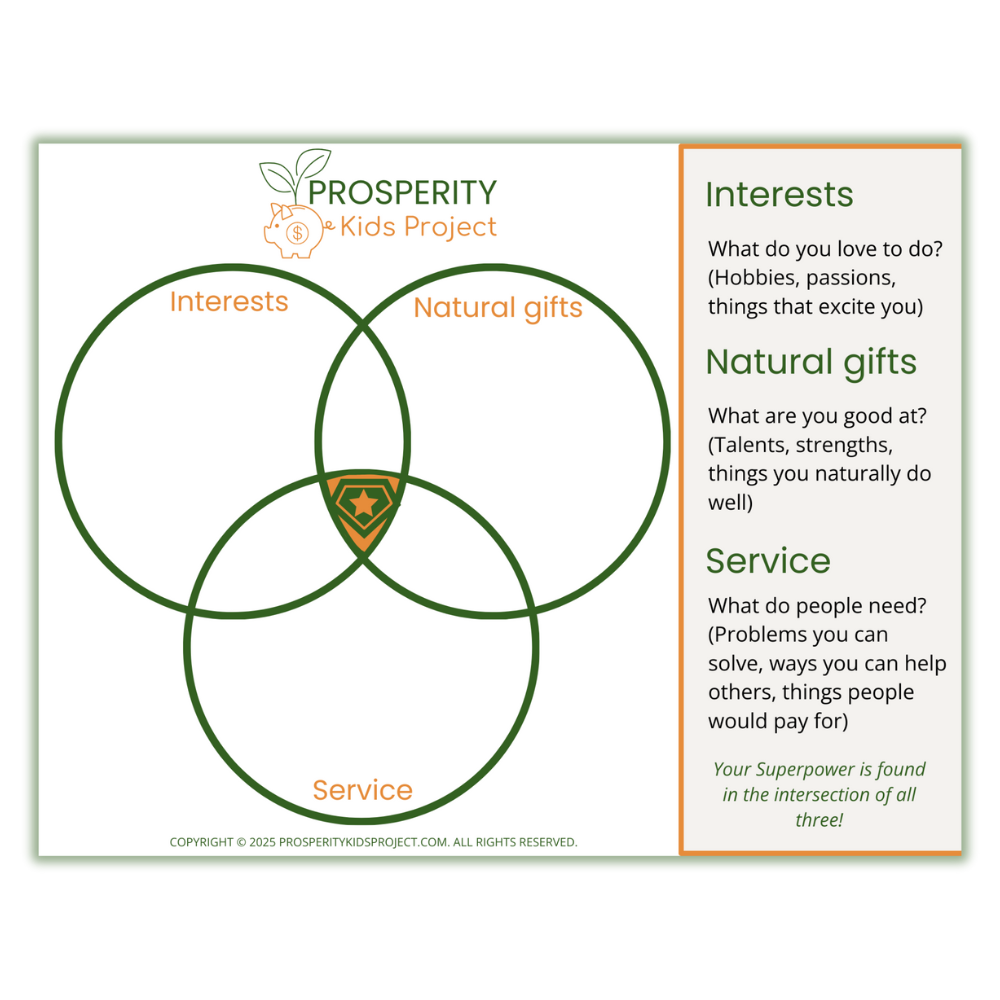

1. Brainstorm ways to serve – Ask your child: “What skills or talents do you have that could help others?” It could be baking cookies for neighbors, mowing lawns, pet sitting, or making handmade cards to sell. Here’s a free worksheet that shows them how to do this in detail!

2. Turn it into a small business – Explain that money is earned by solving problems and serving others. Click here to get a mini business plan guide!

3. Give a portion – Once they make money, encourage them to set aside a part of it to give. Let them choose where it goes—whether it’s a charity, a family in need, or a church donation.

4. Celebrate the impact – Talk about how their business helped others and how giving back made them feel. This reinforces that money isn’t just for spending—it’s a tool to create positive change.

To sum it up, you’ve embarked on a journey to teach kids about finance and money but I hope you understand that it goes beyond building wealth—it’s about shaping them into compassionate, capable individuals who use their strengths to serve others. By fostering curiosity and providing a strong foundation at home, you equip them with the tools to make a lasting impact. When children grow up understanding both financial literacy and the power of generosity, they become unstoppable forces for good in the world.

I love this! It’s so needed in this day and age! Teaching these financial strategies to children while young allows them to develop wise financial habits early in life. Habits that will provide them with greater freedom – freedom from debt, freedom from financial difficulties in relationships, etc.

This is such a great point! Not only is learning how to manage money from a young age important, but also freedom from debt and strain on future relationships like you mentioned is another great benefit of financial education from a young age. Thank you for sharing!